PROPERTY GUIDE

DO NOT JUST BUY PROPERTY!

Follow a Smart Strategy

To Leverage Wealth & Tax Properly

What Are your Priorities?

BUDGETING & SAVINGS PROGRAM

Budgeting provides a roadmap for financial success by tracking expenses and optimising savings. Regular savings contribute to financial resilience, allowing for opportunities and emergencies without incurring debt.

INCREASE WEALTH THROUGH INVESTMENT

Investing can significantly outpace inflation, helping to preserve purchasing power over time. Diversified investments can provide multiple streams of income and reduce risk.

PAYING OFF YOUR HOME LOAN SOONER

Paying your home off sooner reduces long-term interest costs, freeing up significant capital and cash flow for other investments.

INVEST IN PROPERTY

Property investment is a proven and tangible asset class that is stable and appreciates over time. Real estate can be leveraged for future wealth-building and retirement strategies.

CONSOLIDATE DEBT

Debt consolidation can lower interest rates and monthly payments, providing a clear timeline for debt repayment. Managing one payment instead of multiple can reduce financial stress and improve credit scores.

MAXIMISING YOUR SUPERANNUATION RETURNS

Using diversification in different asset classes and leveraging strategies can ensure that your retirement funds are working as hard as possible.

REDUCING YOUR TAX PAID EACH YEAR

Tax planning strategies can support long term financial goals by reinvesting tax savings into debt reduction, reducing your interest charged, as well an investing into other assets to support you in retirement.

ASSET AND PERSONAL PROTECTION

Insurance is crucial for protecting assets against unforeseen events, ensuring long-term plans remain on track. Comprehensive personal protection plans provide peace of mind and safeguard family well-being.

What is Important to You?

Short Term - 2 Years

Mortgage Reduction - Prioritising mortgage reduction can save on interest and build equity faster, offering financial flexibility and security.

Tax Savings - Leveraging tax deductions and credits can increase your yearly savings, providing more capital for investments or debt reduction.

Investments Short Term - Investments can be a stepping stone to accumulating wealth and taking advantage of compund interests early on.

Medium Term - 5 years

Children's Education - Investing in education savings plans now can provide the necessary funds for your children's future education without financial strain.

New Car -Setting aside funds for a new car in a dedicated savings accounts can prevent the need for high - interest loans when the time comes

Renovations - Planning for home renovations not only improves your living space but can also increase your homes market value.

Long Term - 10 Years +

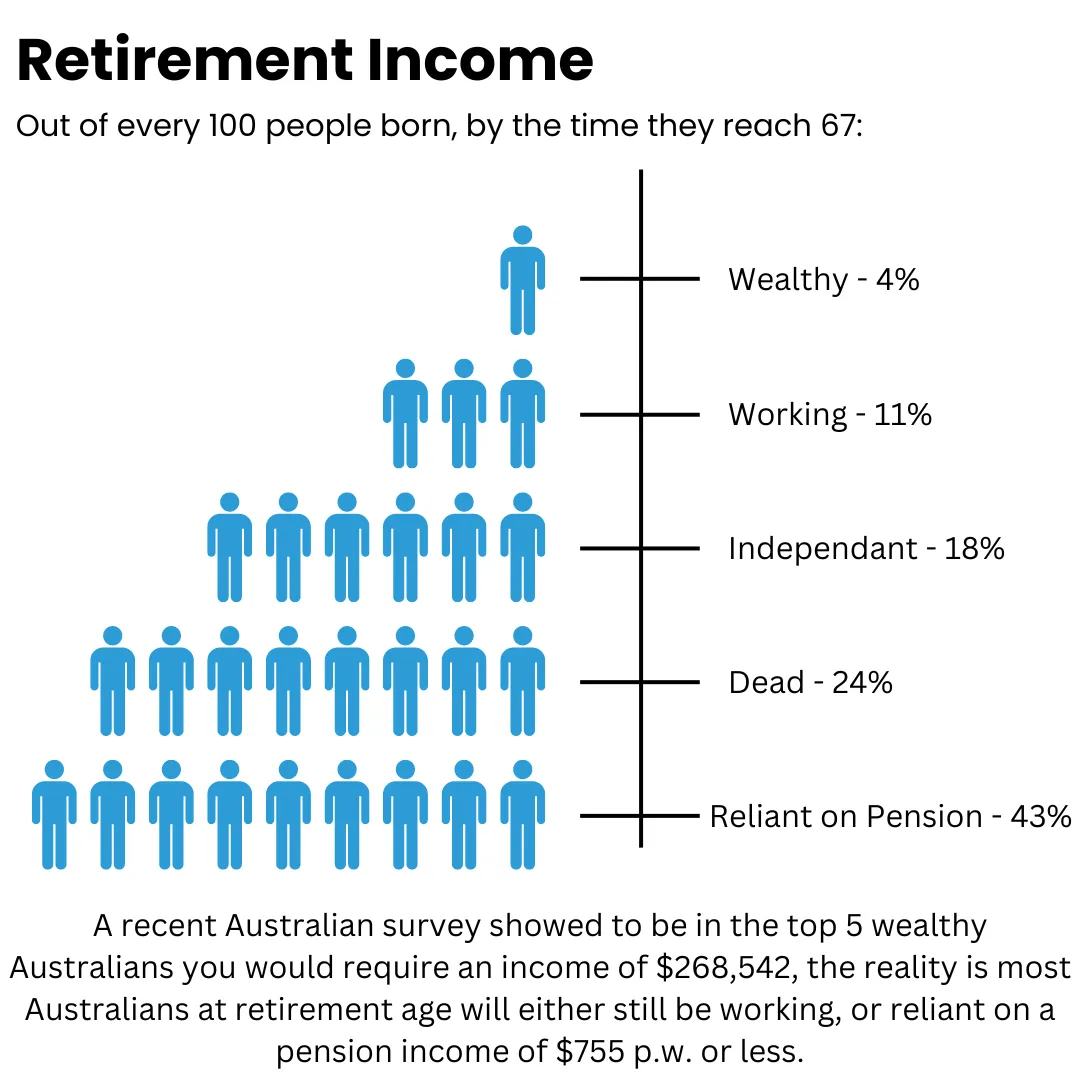

Retirement Income - Consistent contributions to retirement accounts ensure that you will have a steady income to maintain your lifestyle in retirement.

Home Paid Off - Aiming to have your home fully paid off by retirement relieves you of mortgage stress and reduces your cost of living.

Holidays - Planning for holidays involves setting aside funds regularly to afford

your dream vacation without financial worry.

Where are you now?

What’s Important to You?

It is important to consider what really matters to you, whether it be a comfortable

retirement, building up a business or leaving behind a legacy to help your children

when you’re gone. Knowing what’s important to you now can help you to implement

steps to achieve your goals in the future.

Do you have anything in mind to achieve these goals?

If you fail to plan you plan to fail – Not everybody knows what strategies will be

required to achieve their goals, and it is in cases like these you should consider

seeking professional advice to formulate a plan that aligns with your values and

goals. If you do have a plan, that’s great! It is always best to consider having your

plans reviewed by a professional to ensure you are considering the best options to

achieve your goals.

What Steps Have You Taken in the Past?

It is essential to regularly review steps and strategies you have (or have not) put in

place in the past, to see what has worked well for you and what has not. Learning

from mistakes and ongoing reviews will help you to pivot and maximise your

potential to succeed. What has worked well in the past may not work as well in the

future.

What Held You Back in the Past?

The four main factors that hold people back are not having a goal or a plan,

knowledge and financial understanding of their options available, being aware of

their capacity and abilities, and a failure to take action! Setting goals and educating

ourselves on appropriate strategies will overcome fear and allow us to become

confident to make decisions on our future.

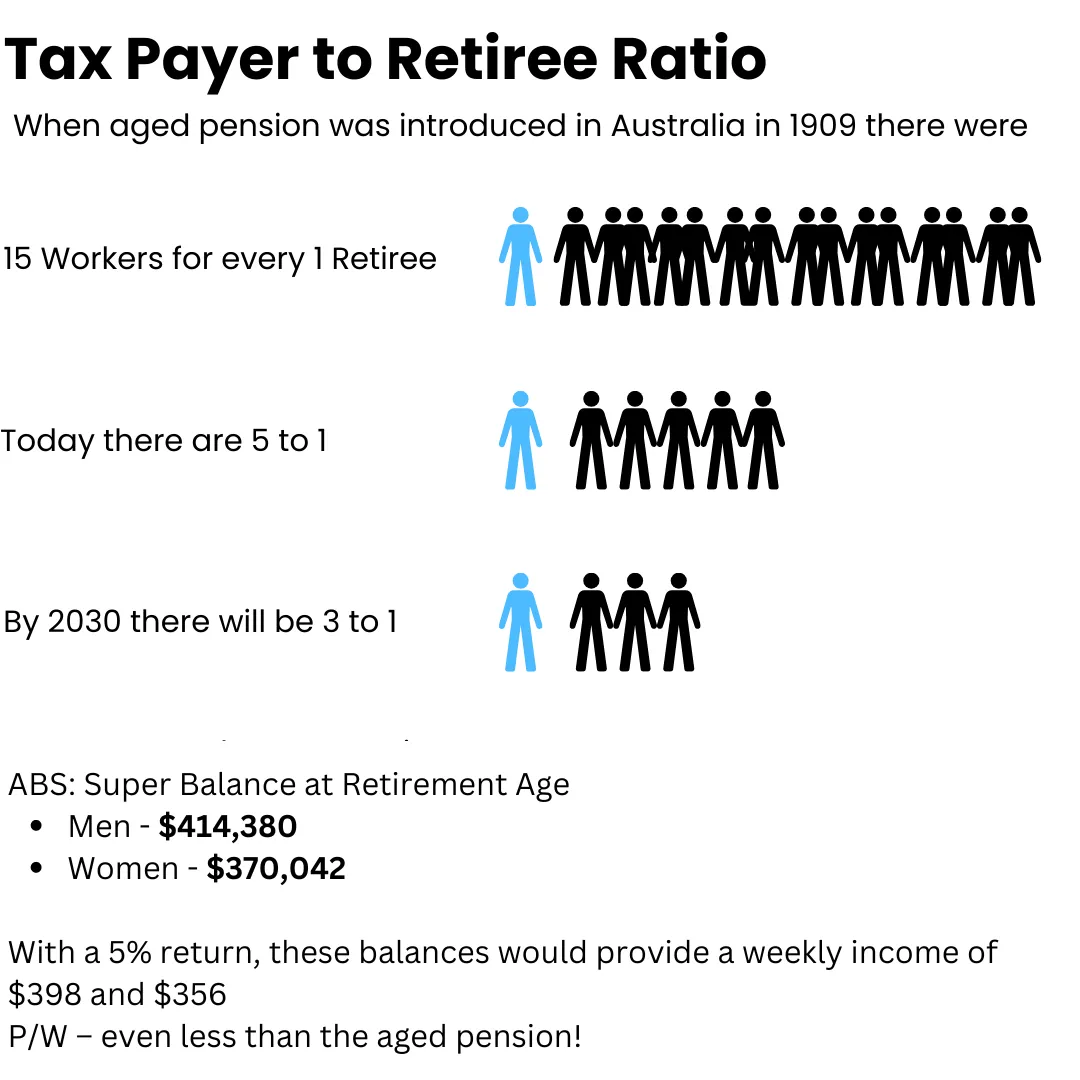

An Awful Truth

More time spent at work

More time when not working

Financial freedom

OUR GOAL

Financial Freedom occurs when you have built up enough residual income from your assets to replace your working income. Therefore, you are no longer reliant on the income from working. Work becomes optional!

WHY WE ASK FOR YOUR CURRENT YEARLY INCOME?

Your current earnings provide a snapshot of your financial landscape. It’s a starting point that helps us gauge:

- How much tax you are paying

- Your potential savings

- Debt reduction strategies

- The pace at which you can achieve your goals

- Balancing immediate needs with future aspirations

WHY WE ASK FOR YOUR IDEAL RETIREMENT INCOME?

Envisioning your retirement lifestyle is the cornerstone of forward-thinking financial planning. By knowing your ideal retirement income, we can:

- Establish a target to aim for

- Ensure your investment strategies are aligned with your desired future

- Calculate the nest egg required to sustain your lifestyle

- Assess the strategies that can bridge the gap between your current position and retirement goals.

how much do you need in assets

| Years | $50,000 | $60,000 | $70,000 | $80,000 | $90,000 | $100,000 | $110,000 | $120,000 | $130,000 |

|---|---|---|---|---|---|---|---|---|---|

| 5 | $1,125,509 | $1,350,611 | $1,575,712 | $1,800,814 | $2,025,916 | $2,251,018 | $2,476,119 | $2,701,221 | $2,926,323 |

| 10 | $1,304,773 | $1,565,728 | $1,826,682 | $2,087,637 | $2,348,592 | $2,609,546 | $2,870,501 | $3,131,456 | $3,392,410 |

| 15 | $1,512,590 | $1,815,108 | $2,117,626 | $2,420,144 | $2,722,662 | $3,025,179 | $3,327,697 | $3,630,215 | $3,932,733 |

| 20 | $1,753,506 | $2,104,207 | $2,454,908 | $2,805,610 | $3,156,311 | $3,507,012 | $3,857,713 | $4,208,415 | $4,559,116 |

| 25 | $2,032,794 | $2,439,353 | $2,845,912 | $3,252,471 | $3,659,029 | $4,065,588 | $4,472,147 | $4,878,706 | $5,285,265 |

Figures based on 5% PA return and 3% PA inflation.

Foundation Of wealth creation

All investments are derivatives of 3 options

Cash

Shares

Properties

A robust investment strategy begins with choosing which asset class you feel most comfortable with, and starting your journey there.

4 Factors that Stop People

No Goals

Money

Knowledge

Failure to take action

Get started!

Take the Survey Below To See How Ready You Are!

© Copyright 2025.Guardian Prosperity . All rights reserved.